First Mover America: BTC Slides Ahead of Busy Data Week

Latest price changes in crypto markets in the context of August 12, 2024.

Latest Prices

CoinDesk 20 Index: 1,925 −2.1% Bitcoin (BTC): $59,616 −1.9% Ether (ETH): $2,675 +0.5% S&P 500: 5,344.16 +0.5% Gold: $2,481 +2.0% Nikkei 225: 35,025 +0.56%

Important news

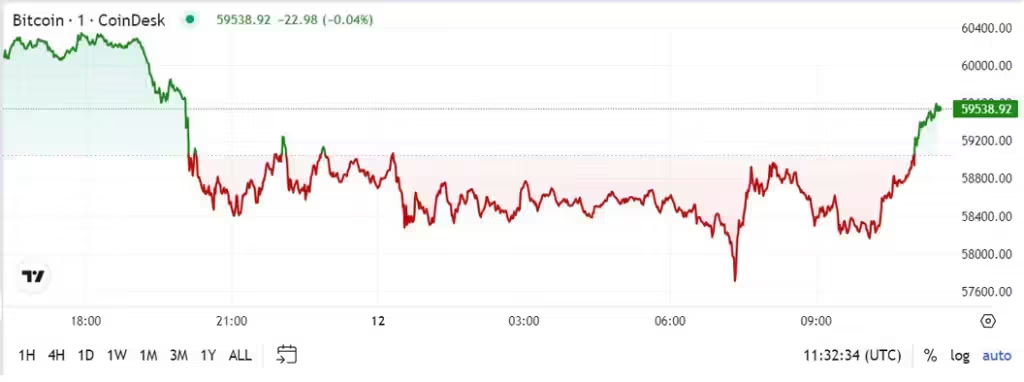

Bitcoin (BTC) slipped towards $58,000 on a sell-off in the crypto market as traders looked for clues ahead of a busy data week. BTC is down about 2.15% in the past 24 hours, sitting below $59,500, while the broader digital asset market has lost about 2.9%, as measured by the CoinDesk 20 Index (CD20). Solana’s Sol led the losses, falling nearly 3% to $149. Data for US-listed ETFs has also been muted, with bitcoin funds seeing $89 million in outflows on Friday and losing $15.7 million to their ether equivalents.

Some market watchers have warned of further declines in BTC in the coming weeks, citing technical weakness and pointing to upcoming economic reports that could provide upward pressure. “Crypto prices will likely be range-bound with a downside bias,” SOFA.org head of insights Augustine Fein told CoinDesk in a Telegram message. “Crypto markets lack a clear anchor and are susceptible to constant position adjustments. We continue to see muted ETF inflows for BTC and ETH over the past few sessions.” Both the U.K. and the U.S. release July CPI readings on Wednesday. Australia’s consumer confidence, which tracks sentiment around family finances, and Japan’s PPI, a price measure. Developments in traded goods within the corporate sector are scheduled for release on Tuesday.

A former Bank of Japan official said the central bank would delay an additional interest rate hike until next year. “He won’t be able to hike again for at least the rest of the year,” Makoto Sakurai said Friday, according to Bloomberg. “It’s a toss up whether they can make a hike by next March.” The BOJ raised its key interest rate on July 31 from a range around zero to about 0.25%, the first increase in a decade.The shift away from the zero interest rate policy pushed the yen higher, triggering an unwinding of the “risk-on” yen carry trades. The resulting slide in traditional risk assets weighed heavily over BTC, crashing the cryptocurrency from roughly $65,000 to $50,000 in less than seven days.

Chart of the day

- The chart shows the decline in Bitcoin prices by percentage since the end of 2022.

- The most recent drop from $70,000 to $50,000 was the largest.

- “As is common with these declines: weak hands waved, and seasoned veterans bought the dip,” Blockware said in an email.

- Source: Blockware, Glassnode

- Omkar Godbole

More Articles

Bitcoin price today: Slide below $60 after weekend sell-off

How to Start a Pet Sitting Business in 6 Easy Steps

7 Ways to Make Money as a Reseller